A study that determines whether the rules of tendering and operation of San Antonio’s ‘Puerto de Gran Escala’ guarantee competition and enhance its efficiency

It is estimated that by the second half of the 2020s, the three container terminals located in the port cities of Valparaíso and San Antonio will not be sufficient to meet demand. New infrastructure will be necessary, not only to accommodate the increase in demand but also to provide a better service to new types of cargo vessels. The current facilities are not the most suitable for the reception and handling of these vessels, so if adequate berthing facilities are not constructed, older and less efficient ships will continue to arrive, thus reducing the competitiveness in terms of our international trade. It was within this context that the design of a mega-port in San Antonio began, the first stages of which would be operational at the end of 2020. Since the Law requires that all ports granted a concession operate in competitive conditions, researchers from the Complex Engineering Systems Institute (ISCI) evaluated the impact of bidding conditions and the rules of operation of the terminal on port competition.

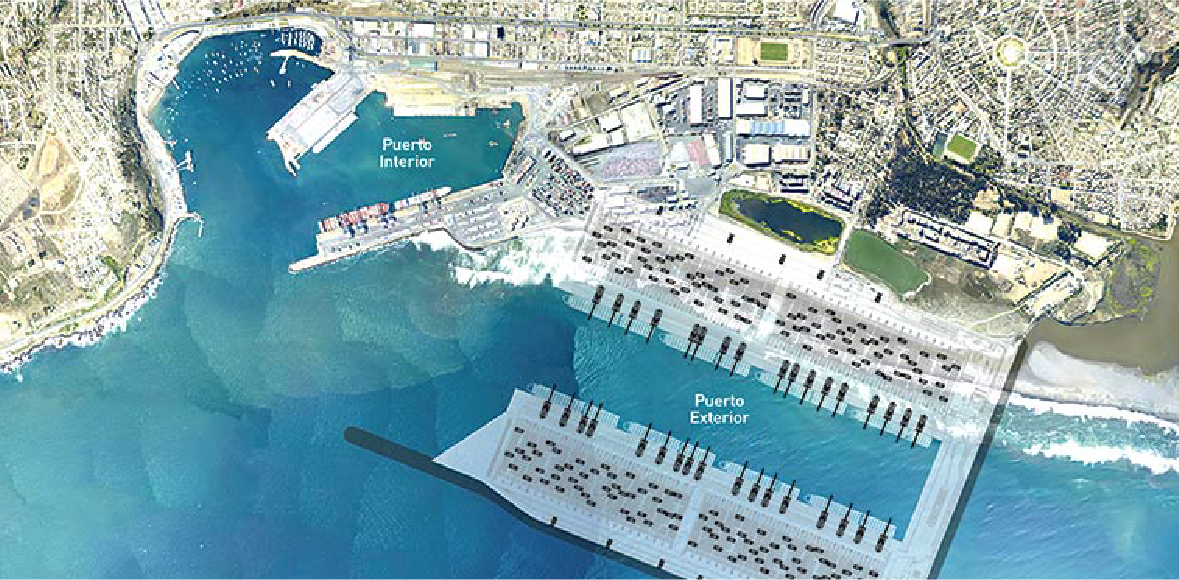

El Puerto de Gran Escala (PGE) will be built on the outskirts of San Antonio in two stages, depending on growth in demand, at a cost of over US$ 3.3 billion. It will be composed of an L-shaped breakwater provided by the State, which will protect two berthing facilities, the ‘Mar’ and ‘Tierra’ terminals, each one 1,730 meters (5,676 feet) in length.

With all stages of the port completed, it will be able to handle eight container ships of up to 397 meters in length simultaneously, shifting in the region of six million TEU (the 20-foot container unit, which is used as a measure of maritime cargo) per annum, almost twice the current port capacity of Chile’s 5th Region.

The global maritime sector has experienced an increase in the concentration of shipping companies, with greater integration between them and the port companies. Set against this backdrop, the first question arose: To what extent would competition be affected were the PGE terminal to be operated by a shipping company?

Research leader, Ronald Fischer explains “In terms of vertical integration, the fear is that if the shipping company is the concessionaire of a terminal it can benefit its ships over those of other companies. However, our conclusion is that since the PGE is a mega-terminal, it’s somewhat difficult for that to happen, since no operator is large enough to use capacity to the full and would therefore need to attract cargo to fully utilize one of the berthing facilities. The experience of other large ports shows that not only are those terminals licensed to a shipping company used by other shipping companies, but the integrated shipping company also often uses berthing facilities of other operators in the same port. With those aspects in mind, our team estimated that a degree of vertical integration between 60% and 80% should be allowed, which allows for the existence of a non-integrated minority partner, whose weight would contribute to reducing the risk of any anticompetitive behavior on the part of a controller. The advantage of allowing integration is that it attracts more participants to the bidding process of the terminal, thus increasing the intensity of competition. If one excessively restricts the possibility of vertical integration, the bidding process would attract very few participants, just the two or three global non-integrated operators, and therefore reduce competition.”

Since the port has two facilities, a second question that had to be answered was how to tender them, optimizing their capacity utilization and ensuring competition. The options were to consider between two and four operators for the terminals, as it is better, a priori, to have more participants.

Working with sophisticated simulation tools, the ISCI team formed by Marcelo Olivares and Pablo Jofré showed that there would be a significant loss in capacity if the Mar y Tierra terminals were divided and each one assigned to two participants. The problem is that when ships of different sizes arrive at smaller berthing facilities – something that occurs when the terminals are divided – this increases the probability of a ship arriving and being unable to dock, since despite there being space available, it is not sufficient. This would not have happened were the terminal operated as a single unit. Additionally, a ship could be serviced by fewer cranes, causing delays in its operations, while cranes sit vacant on the adjacent dock. In contrast, when the entire terminal belongs to the same operator it can optimize the use of its spaces and organize them to receive even the most modern of freighters as well as move the cranes throughout the terminal depending on demand.

“The conclusion is that if there is only one owner of the terminal, you can be more flexible in the use of its infrastructure and increase the capacity. It is true that with two operators in the PGE, competition is somewhat restricted, but the end result is a more efficient port. Again, as there are already three other competitors in the area, the gain in competition by contrasting four operators with five operators (with only the Mar terminal in the PGE) the effect of decreased competition is low compared to the loss in efficiency.”, explains the researcher.

A third question raised in the study asked whether it was appropriate to place a lower limit (Imin) on the rate indices offered as a tender variable for the Mar Terminal concession and, in case of a tie, if the bidding would be settled based on a payment to the State company to finance the breakwater. The offered rate index (ITO in Spanish) is a weighting of freight transfer service rates offered by companies and is fixed for the duration of the concession (30 years).

The Imin was applied in the first tender bids but, subsequently, the Tribunal for the Defense of Free Competition decided that the award of port concessions be based on the rate index, with no minimum. The reasoning for this is that, this way, the efficiency gains were transferred to the users of the operator’s berthing facilities.

The team concluded that it is convenient to have an Imin in the bidding rules. By setting rates in the long term, there is a real possibility that costs, such as labor costs, will surpass projections. This implies a risk for the operator, who will include it in its ITO offer.

Since an ITO is an index of maximum rates under competitive conditions, the rates will normally be lower than the ITO. If the ITO has a lower limit given by the Imin, the effective rates will be the same as those obtained when the tender does not have an Imin since it is the competition after the tender that determines the rates actually charged to users.

But with the Imin, the company has a margin to be able to raise its tariffs against an increase in the costs of all ports, meaning a company that participates in a tender bid with Imin faces less risk than when there is no cap below the ITO bids.

This lower risk means the company is willing to make a payment in order to win the concession if two companies reach this Imin. This payment to the State (or more precisely to the State port company) reflects the lower risk involved when bidding with Imin. It can be shown that with cost risk, market competition and the Imin, an efficient solution is obtained, with effective competition rates and a payment to the State.

Ronald Fischer concludes “We proposed an IMIN in the region of 10-15% lower than the rates of the existing berthing facilities, since they are smaller and less efficient. In the case of a tie at that price, the concession is awarded to the company that is willing to pay more to the State, which will help pay the protection fee that the State should have built to protect the PGE.”